Summary

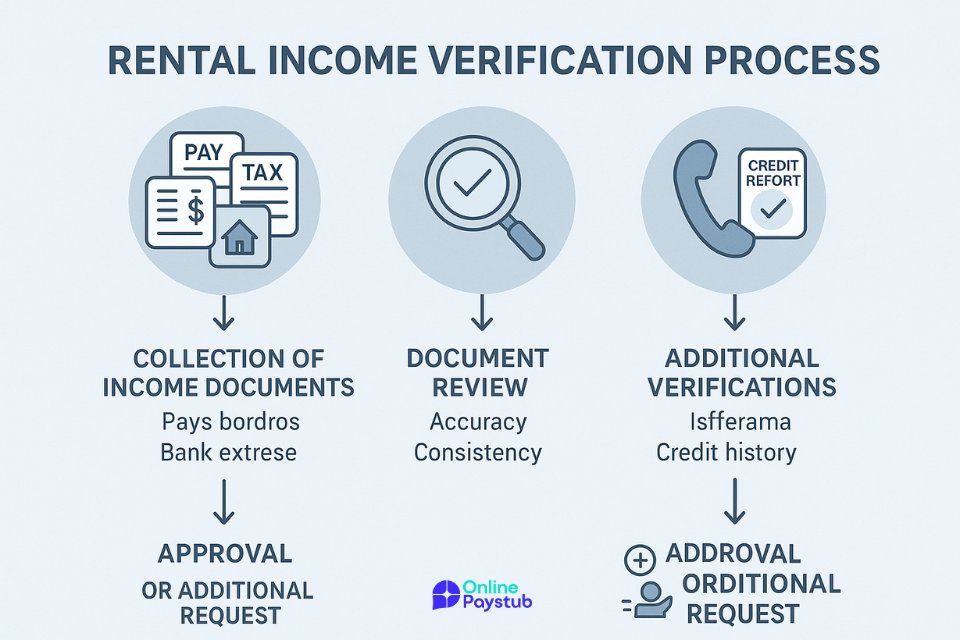

Proof of income helps landlords confirm that prospective tenants can afford rent, typically expecting income to be 3× the monthly rent. Common documents include pay stubs, W-2s, 1099s, tax returns, and bank statements. Freelancers or students can use letters from employers, scholarship records, or app-based income summaries. Tenants without traditional proof may need a cosigner or to prepay rent. Landlords often verify income through direct employer contact, multiple documents, or credit and rental history checks to prevent fraud and assess tenant reliability.

A pay stub is a detailed record of an employee’s earnings for a specific pay period, along with all deductions, taxes, and contributions that affect take-home pay. It breaks down gross income, net income, hours worked, and benefits received. Reviewing it ensures accuracy, helps employees understand their true earnings, and provides a reliable financial record for both personal and legal purposes.

A pay stub is more than just a slip of paper or a digital record attached to your paycheck. It is a detailed summary of your earnings for a specific pay period, along with the deductions, contributions, and taxes that affect your final take-home pay. For employees, it serves as both a financial record and a legal document that confirms how their wages are calculated.

Purpose and Benefits of Pay Stubs

The primary purpose of a pay stub is to provide employees with a transparent breakdown of their earnings and deductions for a given pay period. It is both a financial record and a proof of income that can be used for tax filing, applying for loans, or verifying employment. For employers, issuing clear and accurate pay stubs fulfills legal requirements in many regions and fosters trust within the workplace.

- Proof of Income: Serves as an official record of earnings for loan applications, rental agreements, and other financial verifications.

- Transparency in Pay: Breaks down gross pay, deductions, and net pay so employees understand exactly how their wages are calculated.

- Error Detection: Helps employees identify mistakes in hours worked, overtime rates, tax withholdings, or benefit deductions before they cause financial issues.

- Tax Preparation Support: Provides detailed information needed for accurate annual tax filing and compliance with government regulations.

- Benefits Awareness: Shows the value of employer‑provided benefits, such as health insurance or retirement contributions, which may not be obvious in net pay.

- Legal Compliance for Employers: Many states require employers to provide itemized pay stubs; doing so helps avoid penalties and supports labor law compliance.

- Dispute Resolution: Acts as documented evidence in the event of a pay dispute between employer and employee.

- Financial Planning Tool: Enables employees to track income patterns, plan budgets, and manage savings effectively.

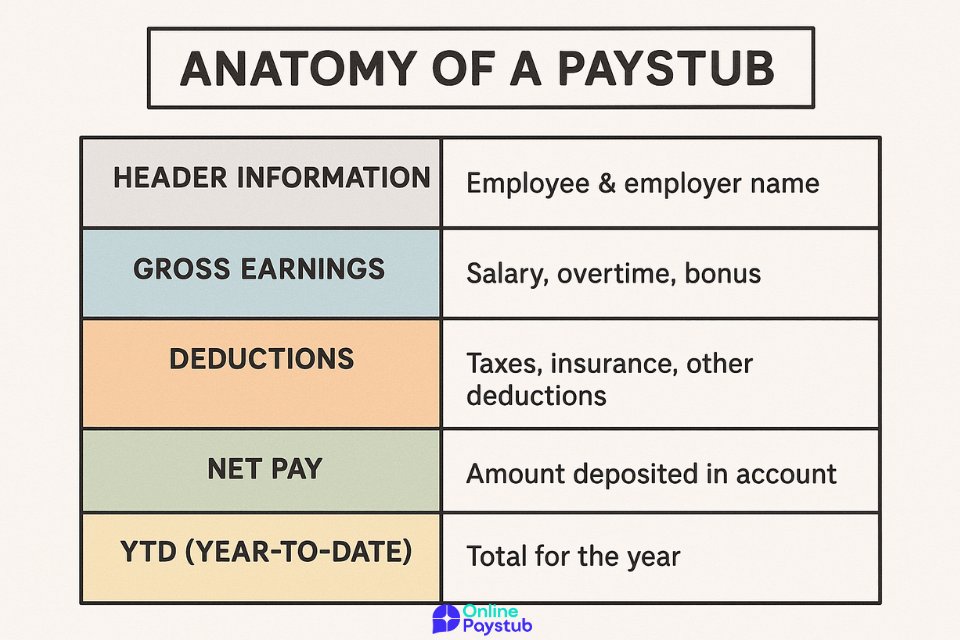

What Information Appears on a Pay Stub?

A pay stub is designed to give both employees and employers a clear, detailed breakdown of every component that makes up an employee’s paycheck. Each section plays a specific role in explaining how gross pay turns into net pay.

Employee and Employer Details

At the top, a pay stub typically lists the employee’s name, address, and employee ID, along with the employer’s name and contact information. These details help ensure the document is clearly associated with the correct worker and company, which is important for record‑keeping and legal compliance.

Gross Earnings

Gross earnings represent the total amount earned before any deductions are taken out. This may include regular wages, overtime pay, bonuses, and commissions. Reviewing this figure helps employees confirm they have been paid for all hours worked and any additional compensation earned.

Taxes and Withholdings

This section shows all taxes withheld from the paycheck. It generally includes federal, state, and local income taxes, as well as Social Security and Medicare contributions. The amounts vary depending on tax rates, allowances, and filing status. Verifying this section ensures correct compliance with tax laws.

Deductions and Benefits

In addition to taxes, other deductions may apply, such as health insurance premiums, retirement plan contributions, union dues, or other voluntary withholdings. These deductions reduce take‑home pay but often provide valuable benefits that support long‑term financial well‑being.

Net Pay

Net pay is the amount the employee actually receives after all taxes, deductions, and contributions are subtracted from gross earnings. This is the figure deposited into a bank account or provided by paycheck.

Year‑to‑Date Totals

Year‑to‑date (YTD) figures summarize the cumulative earnings, taxes, and deductions from the beginning of the year up to the current pay period. This information is especially useful for tax planning and monitoring annual income goals.

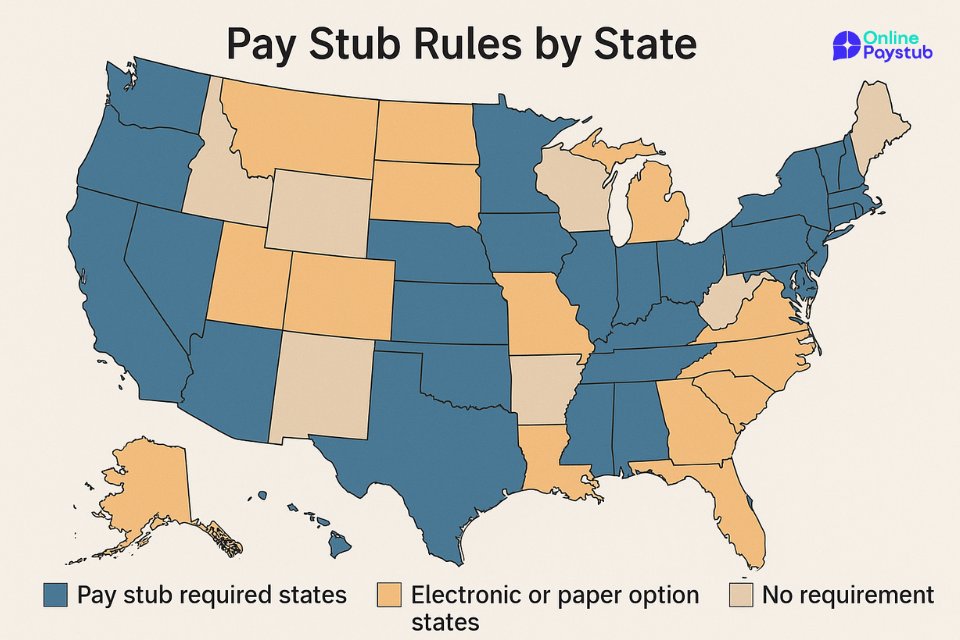

Pay Stub Requirements by State

Pay stub regulations in the United States vary significantly from one state to another. While federal labor laws set certain wage and recordkeeping standards, each state has the authority to decide whether employers must provide pay stubs and in what format. Understanding these rules is essential for both employers and employees to ensure legal compliance and accurate wage documentation.

States That Require Pay Stub Distribution

Many states mandate that employers give employees a detailed pay stub for each pay period. In these states, the document must clearly show earnings, deductions, and other relevant information. The level of detail required can differ, some states require itemized breakdowns, while others allow more basic summaries. Employers operating across multiple states must adjust their payroll practices to meet each jurisdiction’s specific rules.

Electronic vs. Paper Pay Stubs

Some states permit employers to issue pay stubs electronically, provided employees have easy access to view or print them. Others require paper copies unless the employee opts in to electronic delivery. In practice, electronic pay stubs are becoming more common due to their convenience and reduced administrative cost. However, employers must still ensure that digital versions are secure and accessible.

Retention Rules and Recordkeeping

State laws may also specify how long employers must retain pay stub records. This period often ranges from two to four years but can be longer depending on the state and industry. Maintaining accurate records protects employers in the event of wage disputes and provides employees with access to historical pay information when needed.

No comments to show.