Summary

A pay stub should clearly show employee and employer details, gross earnings, taxes, deductions, benefits, net pay, and year‑to‑date totals. This is what a complete pay stub look like when it is easy to read, accurately itemized, and compliant with state requirements to ensure transparency and proper payroll documentation.

What Is a Pay Stub?

A pay stub is an official record provided with each paycheck that details an employee’s earnings for a specific pay period. It includes gross income before deductions, itemized taxes and withholdings, benefits, and the final net pay. Pay stubs serve as proof of income, help verify payroll accuracy, and support personal financial recordkeeping.

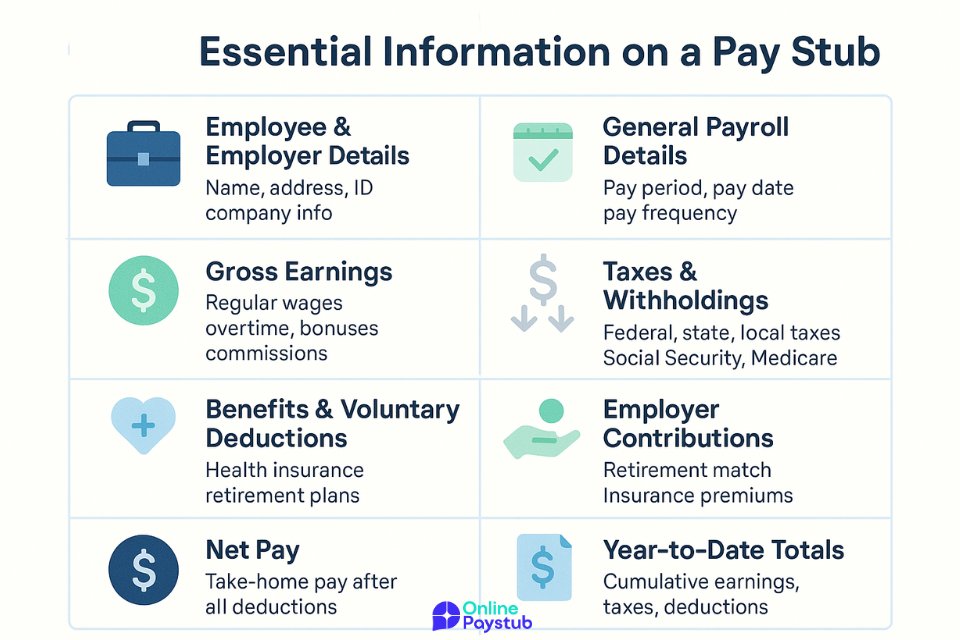

Essential Information on a Pay Stub

A well‑structured pay stub presents all the details an employee needs to understand how their earnings are calculated and what deductions have been applied. The following elements are typically included:

General Payroll Details

Shows the pay period start and end dates, pay date, and pay frequency. These details provide context for the earnings and deductions listed.

Employee and Employer Information

Lists the employee’s full name, address, and employee ID, along with the employer’s name and contact details. This ensures the document is clearly linked to the right person and company.

Gross Earnings

Indicates total earnings before any deductions. May include regular wages, overtime, bonuses, and commissions. This figure is the starting point for all payroll calculations.

Taxes and Withholdings

Itemizes all required tax deductions, such as federal, state, and local income tax, as well as Social Security and Medicare contributions. Accuracy here is critical for compliance.

Benefits and Voluntary Deductions

Details deductions for benefits like health insurance, retirement plans, union dues, or charitable contributions. These reduce take‑home pay but provide added value to employees.

Employer Contributions

Lists amounts the employer contributes toward benefits such as retirement funds, health insurance premiums, or other incentives. While not deducted from pay, these add to the overall compensation package.

Net Pay

Shows the final amount the employee receives after all taxes and deductions. This is the figure deposited into the employee’s account or issued as a paycheck.

Year‑to‑Date Totals

Provides cumulative figures for earnings, taxes, and deductions since the start of the year. Useful for tracking income, planning taxes, and verifying payroll accuracy.

Tax Deductions and Contributions

A pay stub provides a clear breakdown of the deductions and contributions that affect an employee’s final take‑home pay. Understanding these items helps both employees and employers ensure accuracy and compliance.

Employee Tax Deductions

These are mandatory amounts withheld from an employee’s gross earnings. On a properly detailed pay stub, these deductions help define what a complete pay stub look like for compliance and clarity. They typically include federal income tax, state and local income taxes (where applicable), and payroll taxes such as Social Security and Medicare. The amounts are based on earnings, tax rates, and the information provided on the employee’s tax forms.

Benefits and Voluntary Deductions

These deductions are optional and agreed upon by the employee. Examples include health, dental, or vision insurance premiums, retirement plan contributions, union dues, and charitable donations. While they reduce net pay, they often provide valuable personal or financial benefits.

Employer Contributions

Separate from deductions, employer contributions represent amounts the employer pays on the employee’s behalf. Common examples include matching retirement plan contributions, employer‑paid health insurance premiums, and contributions to other employee benefits. These do not reduce the employee’s paycheck but increase the total compensation value.

Common Payroll Allowances

In some cases, pay stubs may include allowances such as travel stipends, meal allowances, or housing support. These can be taxable or non‑taxable depending on regulations and the nature of the allowance.

Why Understanding Deductions Matters

Knowing exactly what is deducted and why helps employees verify paycheck accuracy, plan personal budgets, and prepare for taxes. For employers, transparent deductions strengthen trust and reduce payroll disputes.

No comments to show.