Summary

Form W-2 is a critical IRS form issued by employers by January 31 each year, summarizing an employee’s annual earnings and tax withholdings. Employees can access their W-2 online if their employer uses platforms like OnlinePayStub. If the form isn’t received by early February, it’s essential to contact the employer or the IRS. Alternatives like Form 4852 or IRS Wage and Income Transcripts may be used if the W-2 is unavailable. Accurate W-2s are necessary for filing taxes, verifying income, and correcting any errors promptly.

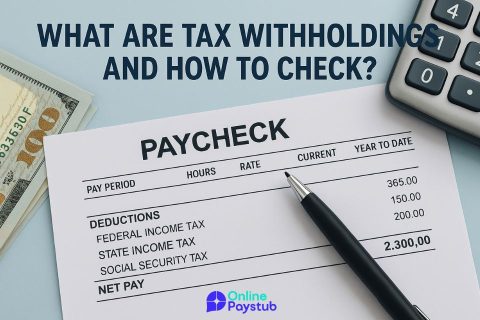

Form W-2, officially known as the Wage and Tax Statement, is an IRS-required form that employers issue to employees at the end of each tax year. It summarizes how much you earned, how much was withheld for federal and state income taxes, Social Security, and Medicare. This form is essential for filing an accurate tax return and for verifying your annual income. It also plays a key role in applications for loans, financial aid, or housing, where proof of income is required.

When to Expect Your W-2 from Your Employer

By law, employers must send W-2 forms to employees by January 31 of the following year. If you’re a current employee, you may receive it in person, by mail, or electronically via your company’s payroll or HR platform. If you’re a former employee, your last known mailing address or digital HR account (if still accessible) is where you should check. If you’ve moved or changed email addresses, notify your employer as soon as possible to avoid delays.

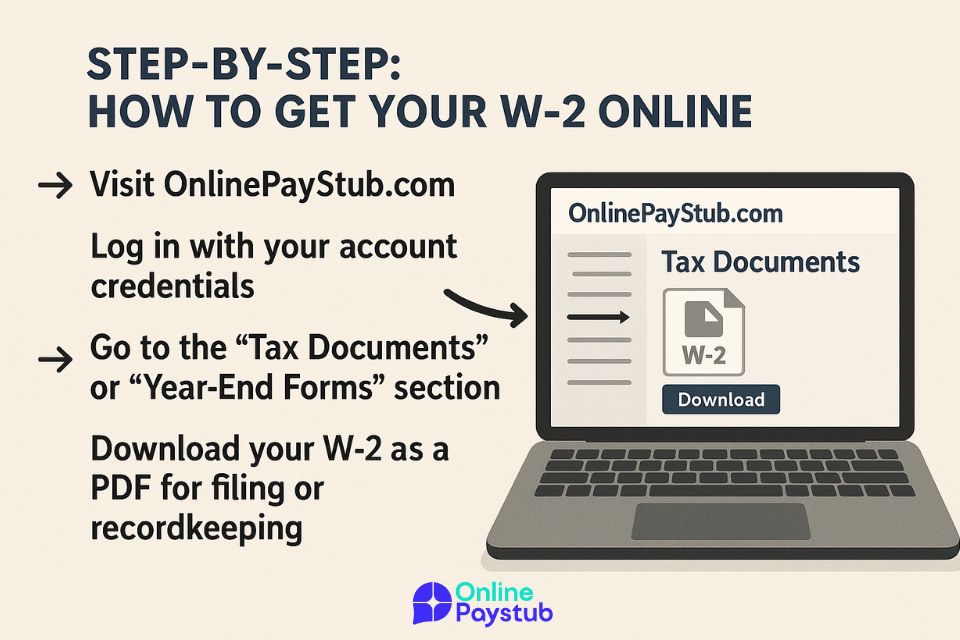

Step-by-Step: How to Get Your W-2 Online

Many employers offer digital access to W-2s through payroll services OnlinePayStubs.

A W-2 form reports your annual earnings and tax withholdings, and it’s essential for filing your taxes. Employers are required to send it by January 31 each year.

If your employer uses OnlinePayStub, you can access your W-2 online easily:

- Visit OnlinePayStub.com

- Log in with your account credentials

- Go to the “Tax Documents” or “Year-End Forms” section

- Download your W-2 as a PDF for filing or recordkeeping

If your employer does not use an online payroll service, you may need to contact them directly for an emailed or mailed copy.

Is it safe to download your W-2 form from Online Pay Stub?

Yes, downloading your W-2 form via Online Pay Stub is very secure. This platform is specifically designed to provide employees with easy access to their pay stubs and tax documents, and it uses the highest security standards.

Online Pay Stub uses encrypted connections (SSL) to protect your personal and financial data. This prevents your information from being viewed by third parties. It also offers additional security measures such as two-step verification during login.

Accessing the platform, viewing, and downloading documents is only possible with the user credentials you have set. This means that only you have access rights.

In conclusion, downloading your W-2 form via Online Pay Stub is both practical and secure. However, remember to log out of shared devices and regularly update your password to protect your personal information.

What to Do If You Haven’t Received Your W-2

If February 1 has passed and you still don’t have your W-2, follow these steps:

- Contact Your Employer: Reach out to HR or your payroll department to confirm whether the form was sent and to what address.

- Update Your Address: If you moved recently, provide your new mailing address immediately.

- Ask About Digital Options: You may be able to access it online through a payroll platform. Like Online Pay Stubs.

- Contact the IRS: If you still can’t obtain your W-2 by mid-February, call the IRS at 800-829-1040. Have your personal information, employer details, and estimated earnings ready.

The IRS may follow up with your employer and send you Form 4852, which can be used as a substitute W-2 to file your return if necessary.

What to Do If You Haven’t Received Your W-2

If your W-2 doesn’t arrive by early February, it’s essential to take action quickly to avoid delays in filing your taxes. Start by verifying your contact information with your previous or current employer. Check your email inbox and spam folder for digital copies, and look into whether your company uses a payroll platform where W-2s might be stored.

Contacting Your Employer for a Missing W-2

Reach out to your employer’s payroll or HR department. Provide your full name, Social Security number, and current address. Request confirmation of when the W-2 was sent and how it was delivered. If you’ve changed addresses, ask if they can resend it or give you access to a digital version.

How to Request a W-2 Copy from the IRS

If you’re unable to get the W-2 from your employer by mid-February, contact the IRS.

Be ready to provide:

- Your full name and contact information

- Your Social Security number

- Employer’s name, address, and phone number

- Your dates of employment

- An estimate of your earnings and taxes withheld

The IRS will follow up with your employer and may send you a Form 4852 to file your taxes.

Understanding IRS Wage and Income Transcripts

Wage and Income Transcripts show data from your W-2 Form and other tax forms submitted to the IRS. They’re typically available in the summer after tax season, making them useful for reference but not ideal for filing during the current season. You can request a transcript via your IRS online account or by submitting Form 4506-T.

Using Form 4852 as a Substitute W-2

If your W-2 still hasn’t arrived by the tax filing deadline, you can use Form 4852 in place of it. This form allows you to enter your estimated wages and withheld taxes, based on your final pay stub. Attach it to your tax return when filing. Keep in mind that using Form 4852 may delay your refund, as the IRS may verify your figures before processing.

Can You File Taxes Without a W-2 Form?

Yes, you can. If you’ve exhausted all other options, filing with Form 4852 is a valid method. However, always try to obtain your actual W-2 first to avoid errors, delays, or audits.

How to Get a W-2 from a Previous Year

You can request past W-2s from:

- Your employer or former employer’s HR department

- The IRS by submitting Form 4506 (fee required)

- Your online payroll account, if the company used platforms like OnlinePayStubs

- Your tax preparer, if they have access to past tax filings

When to Use Social Security Administration for W-2 Requests

The SSA can provide copies of your W-2 for retirement or benefit purposes. If you need it for tax purposes, you’ll need to go through the IRS. Contact the SSA only if you’re verifying earnings for Social Security or Medicare records.

Common W-2 Mistakes and How to Fix Them

Mistakes like incorrect names, Social Security numbers, or wages can cause problems with your return. If you find an error:

- Contact your employer immediately and ask for a corrected W-2 (Form W-2c)

- Don’t file your taxes until you have the corrected form

- If your employer refuses or delays, contact the IRS for further guidance

No comments to show.